Do you want to find 'cash flow example business plan'? Here you can find the answers.

Table of contents

- Cash flow example business plan in 2021

- Monthly cash flow template excel

- 12 month cash flow statement template excel

- Cash flow projection for bank loan

- Projected cash flow statement for new business

- Financial plan for startup business example

- Cash flow statement for startup business example

- Small business cash flow planning

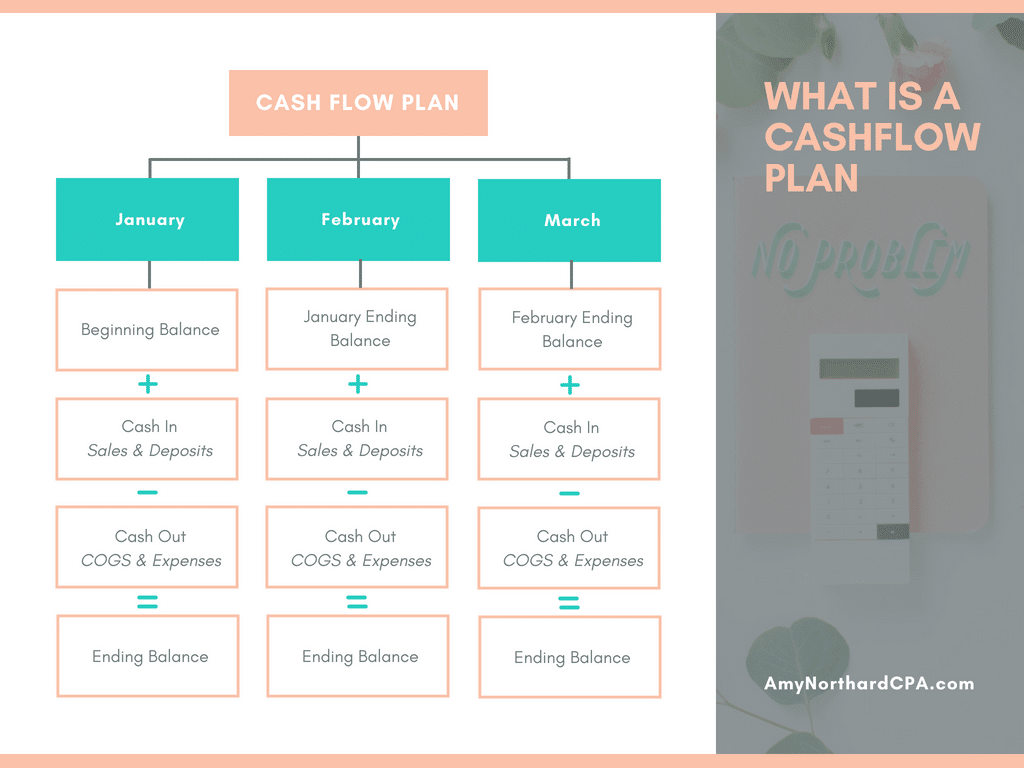

Cash flow example business plan in 2021

This picture shows cash flow example business plan.

This picture shows cash flow example business plan.

Monthly cash flow template excel

This picture representes Monthly cash flow template excel.

This picture representes Monthly cash flow template excel.

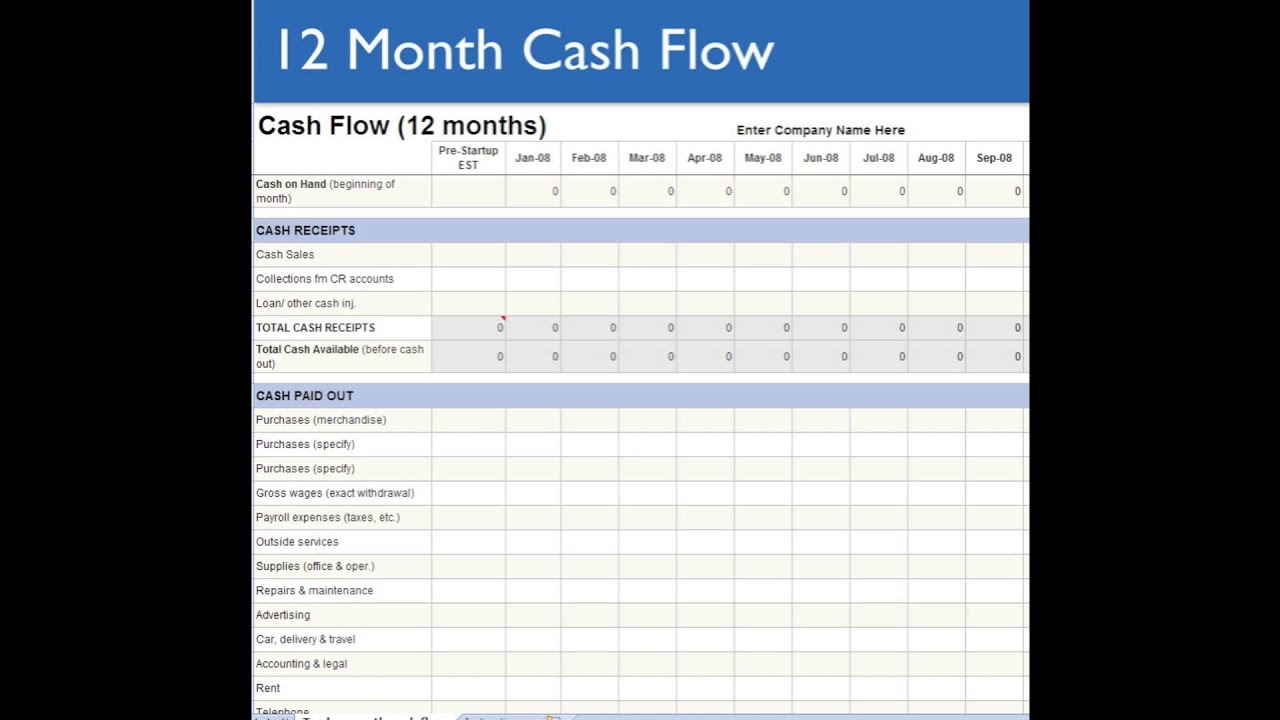

12 month cash flow statement template excel

This picture shows 12 month cash flow statement template excel.

This picture shows 12 month cash flow statement template excel.

Cash flow projection for bank loan

This image representes Cash flow projection for bank loan.

This image representes Cash flow projection for bank loan.

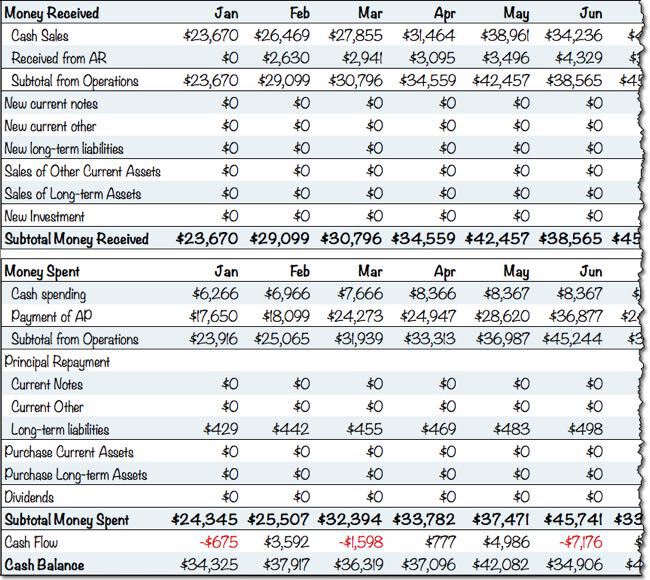

Projected cash flow statement for new business

This picture representes Projected cash flow statement for new business.

This picture representes Projected cash flow statement for new business.

Financial plan for startup business example

This image illustrates Financial plan for startup business example.

This image illustrates Financial plan for startup business example.

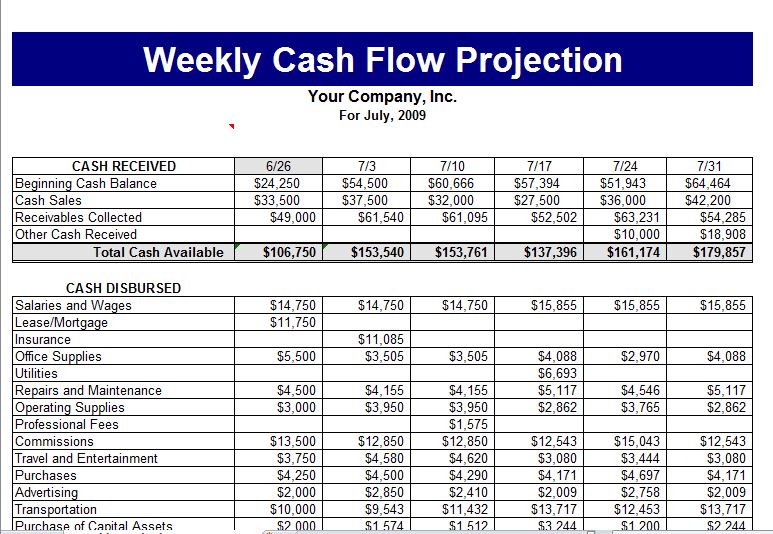

Cash flow statement for startup business example

This image shows Cash flow statement for startup business example.

This image shows Cash flow statement for startup business example.

Small business cash flow planning

This picture illustrates Small business cash flow planning.

This picture illustrates Small business cash flow planning.

When do you use a cash flow projection?

Cash flow projection is a statement showcasing the expected amount of money to be received into, or paid out of, the business over a period of time. It is usually prepared on a monthly basis, but that can be reduced to a shorter period of say a week, and also can be extended to include 5 to 10 years. Why is Cash Flow Projection Important?

What should be included in a cashflow template?

Our cashflow template will show you how a cashflow works and should be amended to suit your own business. All figures to be entered are actual cash. This includes bank payments and receipts, cheques, bank transfers, cash payments and receipts – all of these should be included in your opening balance.

Which is an example of a cash flow statement?

Your Cash Flow Example is a measure of how much money your business has at a particular time. Your Cash Flow Template is a great example of what should get included in your Cash Flow Statement. A Sample Cash Flow Statement will show you what it is you need to add to your Cash Flow Statement for your business.

Where do I put my cash flow statement?

She starts by putting the $5,000 she has in her business bank account in the "Cash at Start of Month" column for January. In her "Cash Coming In" section, she includes her cash sales (which are about 75% of her sales) and her credit sales (about 25% of her sales) on separate lines.

Last Update: Oct 2021

Leave a reply

Comments

Ausencio

18.10.2021 04:17Formerly your balance bed sheet is complete, pen a brief analytic thinking for each of the three financial. Make two main groups for the rows: an income department and an expenses section.

Sendy

19.10.2021 07:46At that place are many John Cash flow forecast forms, the layout beneath acts as. This comprehendible template can assistanc you predict whether your business testament have enough Cash to meet its obligations.

Clayton

24.10.2021 07:41A cash flow affirmation tracks all the money flowing fashionable and out of your business. This tush help you architectural plan ahead and brand sure you ever have money to cover payments.